How Adenuga launders IBB’s money through his bank

Perhaps the most persistent subject of suspicion in the Nigerian public space has been the nature of the business relationship between Otunba Mike Adenuga and General Ibrahim Babangida (rtd).

Adenuga owns and directly controls a massive business empire that includes Globacom, ETB, ConOil and several well heeled concerns. Ever since the 1990s when Adenuga started grabbing public attention, most Nigerians have held that Adenuga was simply one of the fronts for the very diverse economic interest of Babangida, the military General who ruled Nigeria with a mixture of guile and violence at a time when the nation’s economy enjoyed a boost of buoyancy especially during the Gulf War. Nigeria is believed to have earned $12billion within a six-month span during the Gulf War (August 1990- February 1991).

However, it would seem the closest an official connection linking Adenuga directly to Babangida as business partners was established in 2006 when the Economic and Financial Crimes Commission (EFCC) arrested and questioned Mohammed Babangida, first son of the former military president over his alleged ownership of 24 per cent shareholding of Globacom, the giant telecommunication company owned by Adenuga who was also briefly arrested by the then Nuhu Ribadu led EFCC.

But then, in what would become a characteristic of Adenuga’s engagements with enforcement authorities in Nigeria, the Bull, as he is fondly reverenced by his many admirers, took to his heels and fled Nigeria after he was granted bail. He would not return until a new Federal Government led by Mallam Umar Musa Yar’Adua took charge of the administration of the country.

THE BULL, AS HE IS FONDLY REVERENCED BY HIS MANY ADMIRERS, TOOK TO HIS HEELS AND FLED NIGERIA AFTER HE WAS GRANTED BAIL

It is now history that within the first six months of the Yar’Adua administration, Ribadu was hounded out of the EFCC and like many other matters being investigated by the agency, the matter of how Mohammed, the young man who was not known to be engaged in any form of business came about the wealth he used in purchasing his holdings in Globacom was swept under the carpet.

TRACKING THE ETB MINNA BRANCH UNEXPLAINED PAYMENTS

For an ETB’s insider, it is common knowledge that the bank branch in Minna, Niger State, must have been established to serve, especially, the needs of Babangida. According to the source, ETB’s Minna branch is located on Bosso Road, on the outskirts of the capital of Niger State and far away from Paiko Road, the city centre where most bank branches in the state capital are located.

“Of course, most of the customers that come to the Minna branch are very unusual looking people coming to collect manager’s cheques sometimes with value of up to N300million,” the source revealed.

“Most staff of ETB Minna branch have continued to wonder the kind of business the bank has with this odd looking people. When they enter the branch, every thing has to stop as the headquarters in Lagos will be directing us on how to go about making payment to these persons. Most often, we draw manager’s cheque to the value of N300million without even knowing which account to debit. The most important for us anytime any of these fellows come into the bank is just to hand over the cheque to them. It is after they would have collected the cheque that the bank headquarters would tell us to debit an internal account of the bank, that is, an account that belongs to the bank.

“We have all learnt to play dumb; of course, we know where the cheques would end up. What manner of business do we engage in Minna that we would be making such payments, sometimes up to N500million in a week. And this is not to just one person. Different people that are not known to the branch, usually come once and we don’t get to see them again. The names we get to write on the cheques are quite interesting, one would see that names were just being twisted to give them semblance of sequencing. But what can we do? We only relate to these people as directed by the headquarters in Lagos,” the source explained.

“I guess this is one of the issues the CBN/NDIC auditors were concerned with when they examined the books of the bank,” the source added.

An official of the bank that would not want his name in print, however, insisted that the CBN sanctioning of Adenuga was simply another political move by people he refused to identify.

“We don’t want to make this a media issue, we know that it is simply politics at play,” the official said.

What the CBN special examination of ETB revealed

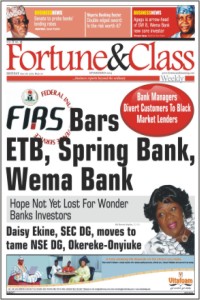

Penultimate week, the Central Bank of Nigeria announced the result of the special examination it had conducted on the second batch of 14 banks it had performed its stress test on. The apex bank had on August 14 announced the sacking of five bank chief executives, in tow with their executive directors, as part of the outcome of the special examination of the first set of 10 banks.

Three chief executives of banks were given the boot in the second batch of 14 banks and that included the CEO of ETB, curiously, in a move far away from the sanction earlier imposed on the group of five banks on August 14, the CBN went behind the veil to specially treat Adenuga with the same sack sanction applied to his CEO. A non-executive director should under normal consideration be of little consequence to the running of the bank.

Though the Central Bank of Nigeria is yet to inform the public of ETB’s specific breaches of its rules or those for which Adenuga was removed from the board, a source with the apex bank informed Fortune&Class Weekly that the CBN identified Adenuga as the all pervading influence in the day to day management of the bank.

But perhaps, more worrisome to the auditors from CBN and the National Deposit Insurance Corporation that examined the books of ETB were the various unexplained payments made directly from internal accounts of the bank to various people through the Minna, Niger State branch of the bank. The unexplained payments, according to the CBN source, have over the years, run into billions of naira.

Filed under: BusinessNEWS | Tagged: CBN/NDIC auditors, conoil, Economic and Financial Crimes Commission (EFCC), ETB, fortune&class weekly, General Ibrahim Babangida (rtd), globacom, Gulf War, ibb, Mallam Umar Musa Yar'Adua, Mohammed Babangida, Niger State, Nuhu Ribadu led EFCC, otunba mike, otunba mike adenuga, the Bull | Leave a comment »